Vietnam has established itself as a stable, rapidly developing, and high growth destination for international business and foreign investment. Its numerous positive business conditions include a stable political system, consistent track record of high performing economic and market growth, ample workforce of young and skilled laborers, central proximity to East Asia’s top emerging economies, and relatively open FDI environment. Its business-friendly policies stand out among its Southeast Asian country peers and encourages a healthy influx of foreign capital.

With a positive 2.58% GDP growth rate in 2021, despite being hit by the COVID19 pandemic, and in good position to return to its norm of 6% annual growth rate in 2022, Vietnam’s economy is outperforming most emerging countries of its scale and attractiveness and offers a solid business climate and vision for its future. It also boasts a continuously improving business ecosystem, and robust free trade network with major agreements in place with participating countries of the EU, RCEP, and CPTPP as well as numerous other countries.

Amidst these conditions, specific trends are also driving further increases in the country’s inbound investment, and making Vietnam a hotbed for companies from around the world that are seeking to:

- Diversify their Asia presence;

- Access the Vietnam and South Asia markets;

- Supplement their China operations; and

- Leverage highly attractive free trade agreements, production, and market advantages.

Many businesses are turning to Vietnam as a safer or second Asia investment option for certain types of manufacturing, product assembly and other downstream services, rather than countries like China. Recent global supply chain and trade shocks, border closures and lockdowns in countries, as well as higher costs of labor have propelled Vietnam to become more competitive than China in some regards.

Vietnam’s economy and borders are open, requiring no quarantine on arrival (read our COVID-19 in Vietnam: Travel Updates and Restrictions here). The government abandoned its original ‘zero-covid’ approach in 2021, which has allowed businesses and production plants to resume operations and create a foundation for the economy to bounce back strongly.

Ease of doing business

Overall, Vietnam ranks #70 among 190 economies (World Bank, Doing Business 2020 report). The US News and World Report meanwhile, ranked Vietnam #7 among 78 countries in which to start a business in 2021, up 5 spots from a year earlier. This reflects Vietnam’s strong navigation through the pandemic and its rapid continued development.

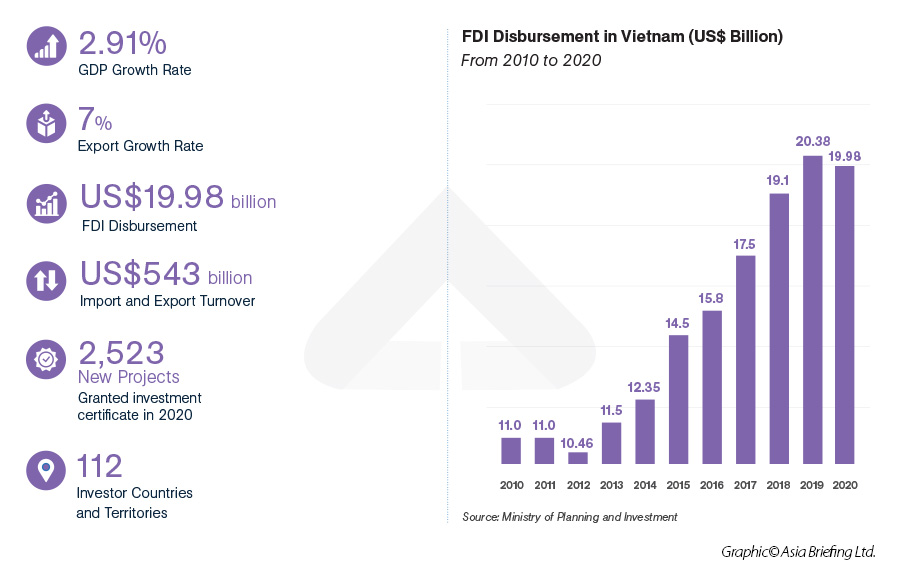

Vietnam also continues to be a magnet for attracting foreign direct investment (FDI), and for leading economic growth — exceeding 2% GDP growth in 2021, and being on pace for a 6.5% GDP growth target in 2022.

Vietnam has a relatively stable government that provides strategic direction and decides on all major policy issues. The government has worked to improve business policies, labor laws, and its ranking as a leading ASEAN region destination for foreign direct investment.

It continues to prioritize infrastructure investment and does not shy away from looking at countries outside ASEAN to fuel its growth. The government has also invested in industrial zones, and this investment is expected to increase as foreign investment continues to pour in.

Economic outlook

A growing economy, expanding middle class and a population of over 95 million have generated significant revenue in Vietnam from retail sales and consumer services. This continues to increase local disposable income for both urban and rural consumers, resulting in a positive growth outlook in consumer spending and FDI in consumer sectors.

Increased consumer spending in Vietnam has contributed to the growth of numerous industries. The needs of Vietnamese people are changing and can be seen in their demand for higher standards across various sectors including education, as well as health and leisure, to name a few.

For example, there is growing demand for high quality education; students enrolled in higher education went from 16 percent in 2005 to 29 percent in 2015.

The digital business landscape is also rapidly evolving and will further impact consumption trends. By 2025, the local digital economy is expected to scale to US$52 billion. Digital economy sub-sectors such as e-commerce, digital banking, and online gaming are nascent and high-growth areas which will be highly attractive for investors.

Vietnam’s Free Trade and tax agreements

Vietnam’s accession into the World Trade Organization (WTO) in 2007 marked its ascension as a committed and robust trade partner for the global community. The country has since entered into numerous Free Trade Agreements (FTA) and Double Tax Avoidance (DTA) Agreements, which have the respective functions of establishing terms of trade that countries impose on imports and exports and eliminating double taxation.

Free Trade Agreements

Vietnam’s membership in the ASEAN (Association of Southeast Asian Nations) bloc makes it a party to the following significant multi-regional FTAs:

- RCEP (The Regional Comprehensive Economic Partnership),

- CPTPP (The Comprehensive and Progressive Agreement for Trans-Pacific Partnership)

- EVFTA (The EU-Vietnam Free Trade Agreement).

In all, Vietnam is a signatory to more than a dozen bilateral and multilateral Free Trade Agreements, offering direct trade advantages with these countries and regions: Australia, Brunei, Burma, Cambodia, Canada, Chile, China, Indonesia, Japan, Laos, Malaysia, Mexico, New Zealand, Philippines, Singapore, South Korea, Thailand, United Kingdom, Vietnam, European Union Countries, Eurasian Economic Union countries.

Vietnam is also negotiating future potential agreements with Israel (Vietnam-Israel FTA) and the European Free Trade Association comprised of Switzerland, Norway, Iceland, and Liechtenstein (Vietnam-EFTA).

Double Tax Avoidance Agreements

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in Vietnam.

More than 80 countries and territories have signed DTAs in place with Vietnam, as of 2022. These treaties eliminate double taxation through identifying exemptions or reducing tax payable in Vietnam for residents of the signatories of the agreements.

It is therefore extremely worthwhile for foreign investors to be aware of which double taxation avoidance agreements (DTAAs) between Vietnam and other countries might be applicable to their situation, as well as understand how these agreements are applied.

Why do businesses relocate to Vietnam?

To size up Vietnam, or any country, as a potential destination for relocation, it is vital that foreign investors diligently research their options across many factors that are relevant to their situation. Such factors may include infrastructure, locations, talent availability, access to raw materials, incentives, supply chain partners and logistics, and others.

Here are some top reasons why companies choose to relocate to Vietnam:

- All of the stated Top Reasons to Invest in Vietnam.

- Vietnam continuous track record of high growth, relative to other low-cost countries.

- Vietnam’s decision to open its borders and economy, discontinuing any previous quarantine or lockdown policies, to make it highly accessible for business, travel and normal living and mobility.

- Numerous industrial zones, workforce and labor availability, lower labor costs and a relatively open environment for foreign direct investments.

- Vietnam is a top “China plus one” destination for dealing with rising costs in China and unpredictable scenarios such as trade shocks. Foreign investors favor Vietnam to supplement their China operations for its lower-cost inputs, alternate markets, and convenient geographic and supply route proximity to China.

Relocating from China

The COVID-19 pandemic, the US-China trade war, China’s lockdowns and “dynamic zero covid” approach, as well as other recent regional and global events have disrupted some China and regional supply chains. This has pressured foreign-invested businesses that had been reliant on China sourcing or production, to diversify or seek alternative destinations. Several countries have benefitted from this diversification, but perhaps none more than Vietnam due to its numerous stated advantages and proximity to China.

China’s costs have been rising for more than two decades, in and around its tier 1 and tier 2 cities and are significantly higher in terms of operating costs than Vietnam’s. There is very high competition in China for skilled labor and coupled with China’s ageing population has resulted in producing labor shortages in certain manufacturing, high tech and other specialized sectors.

While Vietnam’s infrastructure is still unmatched to China’s, the government has prioritized infrastructure development to facilitate economic growth. In April 2021, Vietnam’s transport ministry announced its transport infrastructure master plan between now and 2030, which is estimated to cost between US$43 billion and US$65 billion. Under the master plan, Vietnam will build thousands of kilometers of new expressways, high-speed rail routes, deepwater ports, and new international airports. The government aims for Vietnam to achieve a cargo transportation capacity of 4.4 billion tons per year, and a road transport capacity capable of moving 2.76 tons of cargo and 9.43 million passengers per year – further enhancing the country’s transport network and infrastructure to support investment.

Vietnam’s advantage as a China +1 destination

Vietnam’s position in Asia, and its location along key regional shipping routes offers favorable conditions for Vietnam-based manufacturers to be export-focused in general. It has approximately 3,200 kms of coastline, with 114 seaports (as of January 2022), including numerous deepwater port options along its coasts. These advantages come together strongly, when considering Vietnam as a China +1 destination.

Further, as a China +1 option, Vietnam’s close proximity to China, with both land and sea borders, has positioned it as a likely preferred alternative base for manufacturing for many companies. Cities such as Hai Phong in Vietnam are just 865 km away from China’s manufacturing hub of Shenzhen, for example. By situating manufacturing centers close to traditional hubs in China, manufacturers have been able to reduce their costs and avoid adding interruptions or delays to existing supply chains.

Integrations into China supply chains for foreign-invested companies is aided by the fact that many Vietnam factories are China, Taiwan, and South Korea owned enterprises, which have established robust trading routes and conditions. Transferring existing checklists, specifications, or other product information from such regions has in many cases already been pioneered.

Incentives, workforce and economic zones

Incentives for doing business in Vietnam

The Vietnamese government offers numerous investment-related business incentives and is continually making further improvements through reforms and by further upgrading its incentives to maintain the country’s high appeal to foreign investors. Among all investment incentives, tax incentives tend to be one of the most important to foreign investors and one of the most attractive features of the Vietnamese business landscape.

Tax incentives

Corporate income tax (CIT) incentives are granted to both foreign and local investors, to promote investment in sectors or areas that are on par with the national development strategies. There are two main CIT incentives in Vietnam—preferential tax rates (reduced tax rates), and tax holidays (tax exempted for a certain period or the lifetime of the project). Certain sectors in Vietnam are encouraged for investment through tax exemptions. These include industries which the government prioritizes, such as those it deems qualify for being ‘high tech’, ‘large scale’ or ‘socially important’. Investments into firms that will operate in what the government deems to be a disadvantaged or extremely disadvantaged area can also enjoy a range of preferred tax rates for set terms.

Other incentive types

Several other types of incentives are offered by the Vietnamese government in qualifying, special circumstances. These are explained elsewhere in our incentives guide, and summarize as follows:

- Import duty exemptions may apply for businesses in qualifying situations where:

- Imports are of fixed assets towards qualifying projects;

- Goods are imported for export processing with foreign parties;

- Raw materials and supplies which cannot be produced domestically are imported to directly serve the production of software products;

- Goods are imported which cannot be produced domestically for use in scientific research and technological development.

- Land rental fee exemptions may be available subject to specific conditions for some qualifying investment projects, which primarily involve:

- ‘Encouraged sectors’ in areas of ‘difficult’ or ‘extremely difficult’ socio-economic conditions;

- Where business and production relocation is required due to urban planning or environmental pollution circumstances.

- Specially granted incentives may also be given where qualifying projects encourage foreign investors with large capital amounts and high technologies to make long-term commitments, promote technology transfer and seem likely to propagate FDI spill over effects.

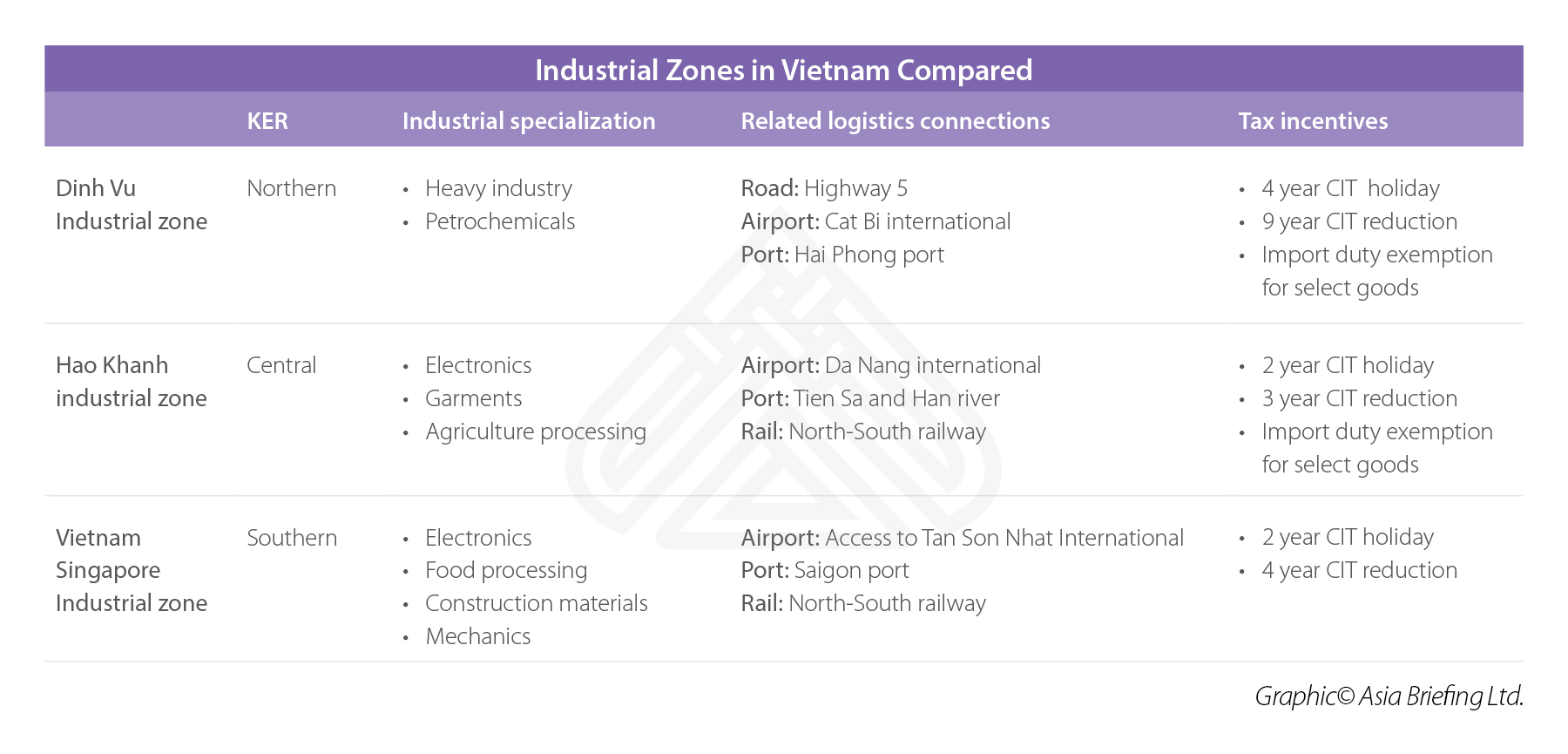

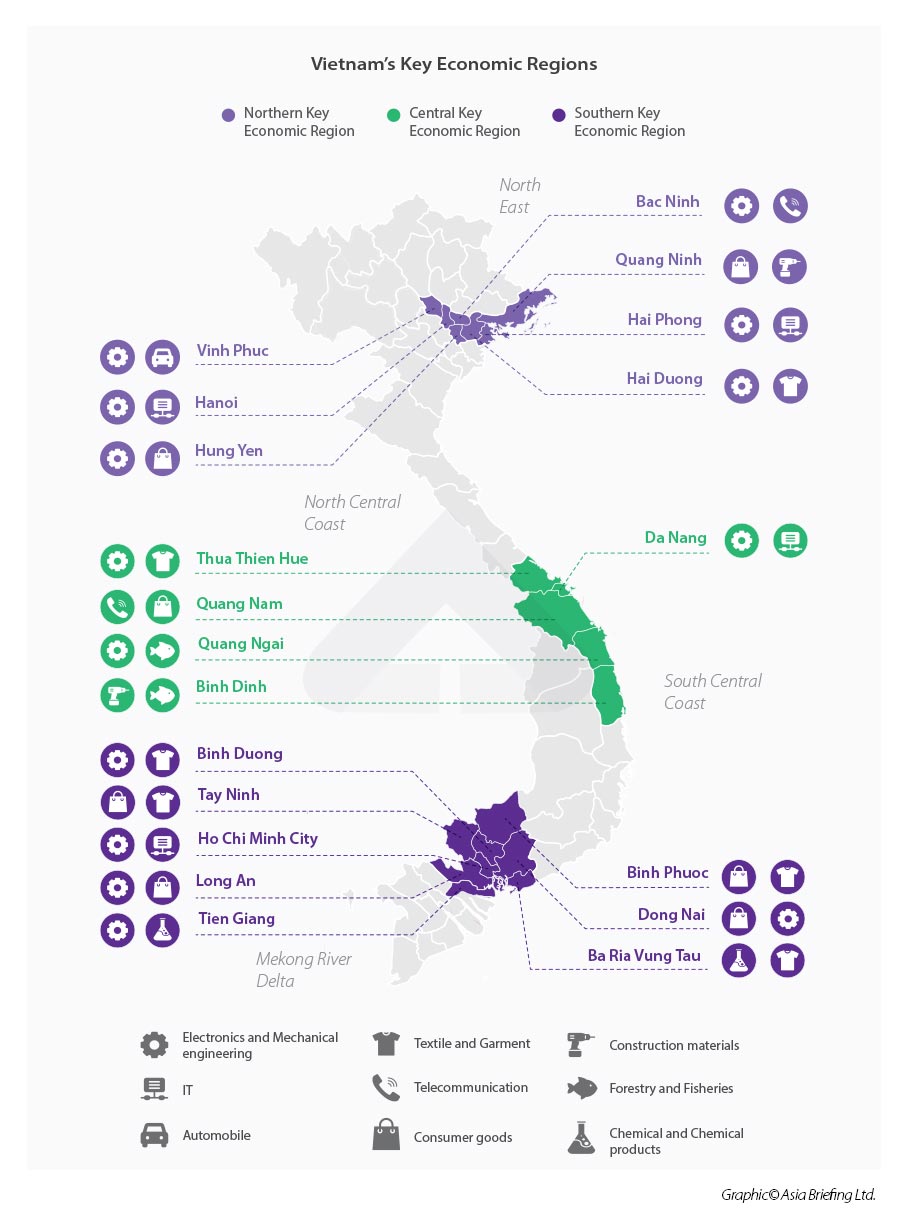

Investment Zones and Industrial Parks

Vietnam’s ‘Investment Zones’ (IZs) and ‘Industrial Parks’ (IPs) are planned areas which had been earmarked by the government to offer investment and manufacturing advantages, and as such, they play a key role in growth and foreign investment.

Industrial Parks are locations where most manufacturing takes place. They offer competitive facilities, infrastructure, logistics, and favorable tax incentives, and thereby offer foreign investors significant opportunities to optimize production and maximize profit. These IPs are concentrated in the North, Central, and South of Vietnam. Based on these locations along trade routes, these zones can be readily integrated into supply chains servicing China, Europe, or Pacific trading partners.

IZs are typically centered around the major cities and economic centers. So, in the North, IZs are located around Hanoi, in the Central region in and around Da Nang, and in the South in and around Ho Chi Minh City. Yet as land prices and occupancies increase over time, IZs are increasingly developed farther away from economic centers.

Our team at Tactical Sourcing is dedicated to finding the right suppliers for your entrance into Vietnam and negotiating the best possible deal. We are experts in the industry, and our freight forwarding team can help streamline your shipping processes and improve your company’s profitability.

So get in touch with us today to discuss your supply chain, as you begin your sourcing journey in the Vietnam market

The TSC Team,